Unlock A New Opportunity

Investor interest in whiskey is at an all-time high throughout the United States. Now, with the support of CaskX, wealth managers can introduce clients to lucrative investment opportunities and help them build their own whiskey investment portfolio.

In today’s global and highly competitive economy, investors are looking for alternatives. They are looking for ways to protect wealth, diversify their portfolio and generate consistent capital appreciation. By leveraging CaskX’s innovative whiskey investment platform, wealth managers can help clients profit by investing in barreled bourbon and scotch whisky casks from top distilleries. It’s a simple and powerful way to provide investors with access to an asset class rising in prominence.

The Bourbon Boom Continues

All across Kentucky the signs of the ongoing “Bourbon Boom” are obvious throughout the Bourbon Trail with the construction of new rickhouses, visitor centers and bottling facilities springing up at nearly every distillery. Over $2.3 billion has been allocated to the construction of infrastructure to support the bourbon industry in Kentucky alone, with a similar sentiment permeating throughout other regions of the country. There’s no denying there are big things in store for the future of whiskey.

As CaskX continues to build relationships with more distilleries across the United States, exciting new offerings are on the horizon that will allow investors to build a diversified portfolio with some of the best whiskey around.

Whiskey investing is just starting to garner mainstream appeal. In contrast to other financial markets such as stocks, bonds and commodities, individual investor capital is just beginning to flow into the industry. Investors around the world are taking note of this new opportunity and building whiskey portfolios that span different regions, mashbills and distilleries.

Why Invest In Whiskey?

1. An Investment That Gets Better With Time – Whiskey casks are one of the few tangible investments that actually get better with time.

2. Consistent Growth – Whiskey casks have shown stability in performance over the past few years as shown by the Knight Frank Luxury Investment Index and WhiskyStats.net.

3. Inflation Hedge – Leading financial advisors are recommending a larger allocation of tangible assets be included as a hedge against projected inflation.

4. Protection From Economic Turbulence – The 2020 Knight Frank Wealth Report shows that whiskey sales do not typically demonstrate the volatility we have seen in equity markets, commodities, property or precious metals.

5. Strict Oversight & Stringent Regulation – Due to the government oversight of spirits, each barrel must be stored in bond and tracked. This provides a safeguard for investors.

Direct Distillery Partnerships

The quality, desirability and long-term growth of a whiskey is driven by the underlying distillery.Distilleries must have a proven track record for delivering spirits that meet the highest standards and have resonated with consumer preferences.By working directly with the rising stars of the whiskey world, investors can capitalise on higher capital appreciation, lower storage costs and simple exit strategies.

Personalized Strategies

CaskX enables wealth managers to construct whiskey investment portfolios based on an investors unique objectives and strategy. CaskX believes in developing personalized strategies to align with investor goals. A variety of offerings allow a wealth manager to provide recommendations based on budget, timeframe, targeted returns and market preferences. This proven process produces whiskey portfolios that have, historically, met or exceeded expectations.

CaskX provides complete support to wealth managers in training, marketing, acquisition and post-purchase customer service. You can rest easy knowing that the CaskX team is just a phone call away for any questions or concerns that may arise.

Monitoring & Reporting

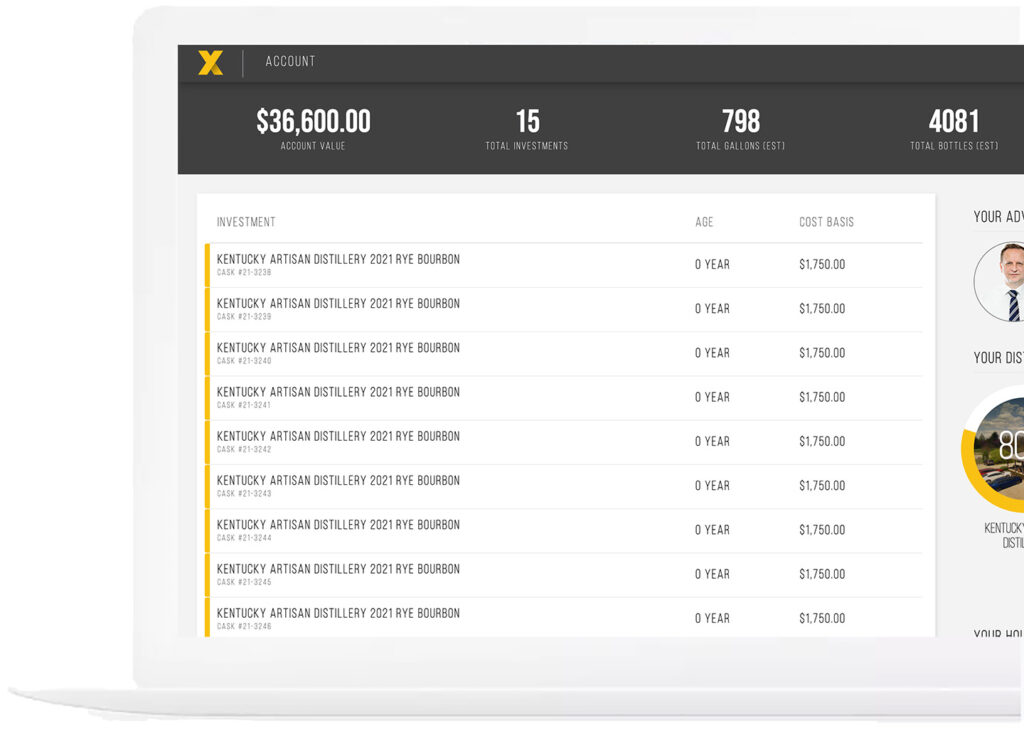

CaskX has developed an innovative online management portal that brings transparency and real-time reporting to the world of whiskey investment.

CaskX hired leading technology architects to build an online portal that provides investors with unprecedented levels of control. Real-time monitoring of assets delivers timely insights to investors to empower them to make decisions relating to their portfolio. By putting all of the information relating to investments at an investors fingertips they are able to make well-informed decisions at every stage of the investment lifecycle.

Join The CaskX Wealth Manager Program

Wealth management firms today are looking to offer investors a broader range of products to protect wealth, diversify their portfolio and generate consistent returns.By leveraging CaskX’s innovative program, leading wealth managers can help clients invest in full barrels of whiskey from distilleries across the United States.It is a simple and powerful way provide investors with access to an asset class rising in prominence.

Apply to join the CaskX Wealth manager Program and, upon acceptance, you can get access to current whiskey investment offerings.